Strategic Capital: A Guide to Financing EarthCore Projects

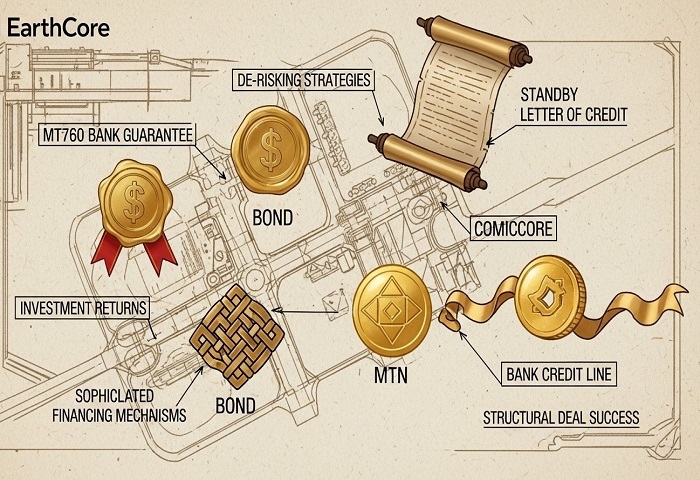

At EarthCore, we develop large-scale, transformative infrastructure projects that redefine nations and generate stable, long-term returns. The scale and ambition of our ventures require sophisticated and diverse financing strategies. For our prospective investors and partners, understanding these mechanisms is key to appreciating how we de-risk investments and structure deals for success.

This article outlines the primary financial tools we employ to bring our critical projects from blueprint to reality.

1. Monetization of Bank Instruments (MT760 Bank Guarantee & Standby Letter of Credit)

What it is:

This method involves using a high-quality bank instrument as collateral to secure immediate, liquid funding for a project's early stages, such as mobilization or initial construction.

MT760 Bank Guarantee (BG):

An MT760 is a SWIFT message used by a bank to verify the existence and authenticity of a Bank Guarantee it has issued. The guarantee itself is a promise from a bank (the Issuing Bank) to cover a financial obligation if the borrower (EarthCore or our partner) defaults. For investors, the MT760 provides irrefutable proof that the guarantee is held in a secure, blocked account.

Standby Letter of Credit (SBLC):

Similar to a BG, an SBLC is a commitment from a bank to pay a beneficiary if the applicant fails to meet the terms of a contract. It "stands by" as a guarantee of performance or payment.

How EarthCore Uses It:

A project partner or investor provides an SBLC or BG from a top-tier, rated bank. EarthCore then presents this instrument to a specialized trade finance or investment fund. This fund, upon verifying the instrument via MT760, will "monetize" it. This does not mean drawing on the guarantee; rather, it means providing a low-interest loan (typically 40-70% of the instrument's face value) using the BG/SBLC as security. This provides the crucial non-dilutive capital needed to launch the project, which is later refinanced through a long-term loan or bond once certain milestones are hit.

2. Funding via Monetization of a Bank Credit Line

What it is:

This strategy leverages an established credit line to generate project capital without the entity drawing on the line directly, thus preserving its balance sheet.

How EarthCore Uses It:

An entity (often a financial partner) with a significant, unused credit facility at a major bank can monetize this available credit. They can use the credit line as collateral to obtain a loan from a third-party institutional lender specifically for the EarthCore project. Alternatively, they can request their bank to issue an SBLC on their behalf, drawing against the credit line. This SBLC can then be monetized as described in the first point. This tool is effective for tapping into large, pre-approved capital sources efficiently.

3. Funding via Monetization of Bonds and Medium-Term Notes (MTNs)

What it is:

This is a capital markets solution for larger, more mature projects or portfolios of projects. It involves issuing debt securities to a wide pool of institutional investors.

Bonds:

A bond is a fixed-income instrument representing a loan made by an investor to a borrower (e.g., an EarthCore project-specific Special Purpose Vehicle - SPV). Corporate or project bonds have terms typically exceeding 10 years.

Medium-Term Notes (MTNs):

An MTN is a debt security that, as the name implies, has a medium-term maturity date (usually 5-10 years). The key advantage of an MTN program is its flexibility. Once a program is established, EarthCore can issue notes on a continuous or "tap" basis with different maturities and interest rates to suit market conditions and specific funding needs.

How EarthCore Uses It:

For a major infrastructure project like a power plant, we would establish a project finance SPV. This bankruptcy-remote entity would issue bonds or MTNs. The proceeds fund the project's construction. Repayments to bondholders are made solely from the project's revenue stream (e.g., power purchase agreement payments). This aligns the investment's success directly with the project's performance and attracts institutional investors like pension funds seeking predictable, long-duration cash flows.

4. Recourse vs. Non-Recourse Debt Financing

This is a fundamental distinction in project finance, defining the lender's claim on the borrower's assets beyond the project itself.

Recourse Loan:

A loan where the lender has full claim on the borrower's assets and cash flows if the project fails to generate sufficient revenue for repayment. This type of financing is often used in a corporate context or for the early stages of development where the project SPV has no assets. It is typically cheaper due to the lower risk for the lender.

Non-Recourse Loan (Limited-Recourse Loan):

The cornerstone of major project finance. In a non-recourse structure, the lender's only collateral is the project itself and its future revenue streams. If the project fails, the lender has no claim on EarthCore's corporate assets or those of our equity partners. This protects investor assets but is more expensive for the project SPV, as the lender assumes significant risk. Lenders mitigate this risk through rigorous due diligence, robust project contracts, and requiring significant equity investment upfront.

How EarthCore Uses It:

We primarily utilize limited-recourse debt for our major projects. This structure makes our corporate balance sheet and attracts pure-play project investors. It demonstrates immense confidence in the project's fundamental economics and risk mitigation strategies.

5. Equity Financing

What it is:

The foundation of all project finance. Equity represents ownership in the project SPV. Equity investors are the last to be paid from project cash flows but enjoy the highest potential returns after all debts and obligations are met.

How EarthCore Uses It:

A significant equity portion (typically 20-40% of total project cost) is required to make the project "bankable" and attract debt financing. EarthCore sources equity from:

- **Sponsor Equity:** Capital invested by EarthCore itself, demonstrating our skin in the game.

- **Strategic Investors:** Industrial partners who bring expertise and a strategic interest in the project's success (e.g., an equipment manufacturer).

- **Financial Investors:** Institutional investors, private equity funds, infrastructure funds, and family offices seeking long-term, inflation-protected returns.

- **Government Partners:** In some cases, host governments may take an equity stake to align interests and share in the project's success.

Equity investors bear the highest risk but are rewarded with control over the project and the largest share of the profits upon a successful exit, often through a refinancing or sale after the project becomes operational.

Conclusion: A Tailored Financial Architecture

At EarthCore, there is no one-size-fits-all solution. Our financial experts meticulously structure each project's capital stack, often blending several of these tools to optimize cost, risk, and timing. From initial mobilization using monetized instruments to long-term funding via project bonds and non-recourse debt, we architect a financial foundation as robust and innovative as the infrastructure we build. This strategic approach to capital ensures that every EarthCore project is not only a engine of societal transformation but also a meticulously de-risked and compelling investment opportunity.